Objective

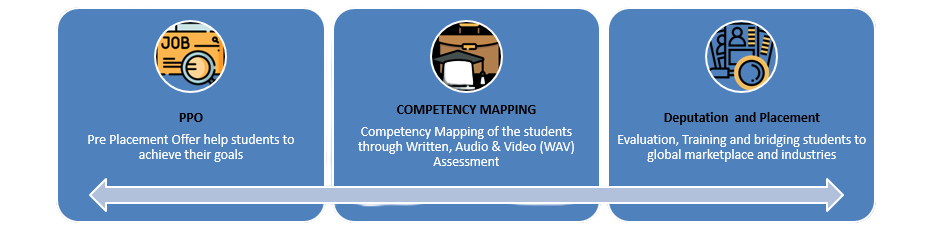

We have developed Strategical Banking and Academics Inclusion Process to uplift the capacity of educational institutes. To create an impact on traditional educational system by innovating the alignment of R&D Institute, Implementation Institute, Industry and Bank together to impose the impact. The purpose of this process is to acquire your students for the same and prepare them for strategic and senior management.